If you’re keen to save the tax on your children’s gifts this year — as Prime Minister Justin Trudeau promised — it’s best to keep a close eye on your receipts.

On Tuesday, TorontoToday put the federal government’s tax holiday — which came into effect on Saturday — to the test, visiting eight retail stores to purchase children’s toys.

At three of eight shops in Toronto, our reporter was charged HST on toys that appear to fall under the government tax exemptions — even at big-box retailers Toys R’ Us and Walmart.

Reached later, a spokesperson for Walmart Canada said the products purchased had been taxed in error and said it would be fixed.

Under federal and Ontario government rules for the tax program, retailers are supposed to exempt many kid’s toys from HST until February 15 as part of a policy effort to put more money back in Canadian’s pockets.

Under the new program, children’s stuffed animals, board games and toys that imitate another item, “whether real or imaginary,” are supposed to be tax exempt for the holidays.

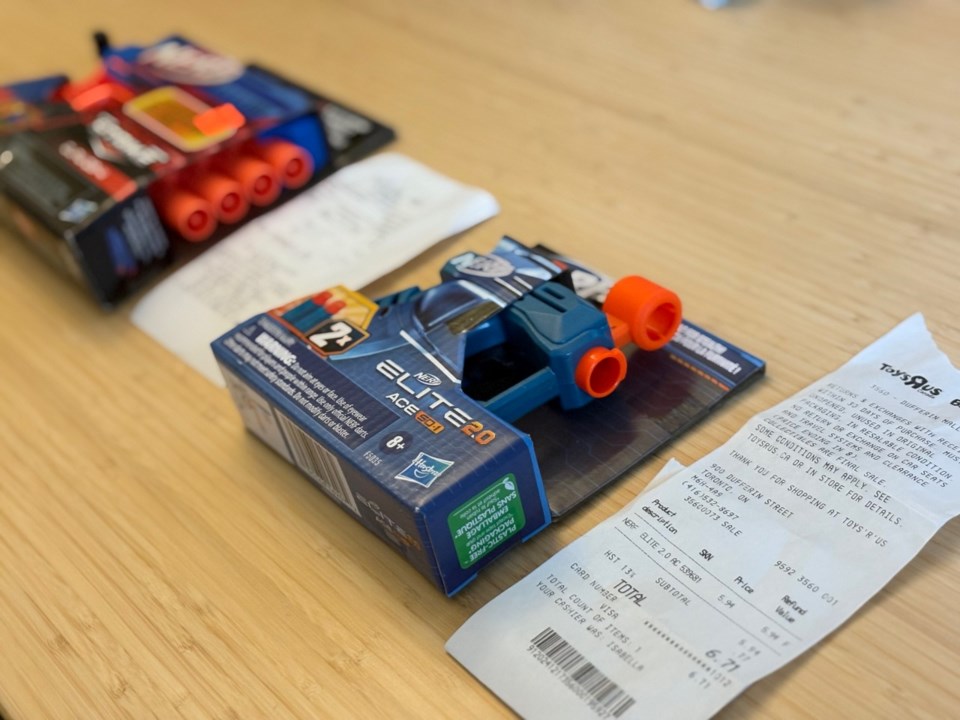

Two Nerf guns — one taxed, one not

On Tuesday, TorontoToday purchased a Nerf gun at the Toys R’ Us in Toronto’s Dufferin Mall.

But though the store advertised the tax break to customers at the entrance and checkout, HST was applied on the item. Asked about the discrepancy, the cashier said some products have tax while others do not.

“It just depends,” she said.

TorontoToday contacted Toys R’ Us to inquire why the product was not tax-free, but did not hear back by publication time.

Reached by telephone, a store manager at the Dufferin Mall location said it’s the corporation’s head office that is responsible for determining which items are tax-exempt, suggesting Nerf guns are likely taxed at all of the retailer’s outlets.

Toronto residents keen on tax-free Nerf guns shouldn’t despair, however.

At family-owned Playtime Toys in the same mall, there was no HST applied when TorontoToday purchased a slightly larger Nerf gun for $8.99.

Asked about their policy, the shopkeeper said most everything in their store is tax-free right now, save for some stationary items.

Plush toy problems

TorontoToday found the same discrepancy on purchases of stuffed animals. At Shoppers Drug Mart, a TY Beanie Baby tiger was tax-free, whereas a cactus and snake purchased at Walmart were not.

“As we worked to prepare for the federal government’s tax break, we reviewed over a million items across many categories to remove tax,” said Stephanie Fusco, a senior manager at Walmart Canada.

“These two items were unfortunately missed during our review. We immediately corrected our system to ensure they are no longer taxable.”

Fusco said if a customer believes they were charged tax incorrectly, they should visit a store with their receipt for a refund.

Dan Kelly, CEO of the Canadian Federation of Independent Business, said it’s “no surprise” the so-called tax holiday isn’t being applied with perfect consistency.

“I think this is just a symptom of the problem that [the] government created by rushing to create a political holiday … two weeks ahead of Christmas,” he said. “There is mass confusion on the part of retailers of what’s in and what’s out.”

Kelly said stores like Walmart that sell a wide variety of items are facing the greatest difficulty in implementing the tax policy.

“I think people think this is just a press of a button and voila, the tax is off, but it often requires some reasonably sophisticated re-engineering of your point of sale systems,” he said.

Retailers have been thwarted, too, Kelly said, by the government’s creation of brand new tax categories for this program.

While toys intended for children under 14 are generally tax-exempt, older kids’ toys are mostly taxable, according to the rules.

These sorts of specific guidelines mean retailers have to newly assess the demographic of each toy, he said. “It’s super hard to get right.”

Penalties for not applying tax?

In a press release about the program in November, the federal government said it expected businesses to comply with the policy change.

However, Kelly said some retailers are choosing to continue to charge HST over a fear they might accidentally remove the tax on items that do not qualify under the program.

It is unclear if there are penalties for a business that doesn’t comply with the tax break.

TorontoToday contacted the CRA to inquire, but did not receive a response by publication deadline.

Independent store reimbursement

On Tuesday, TorontoToday purchased a tic-tac-toe game for $1.99 plus tax from an independent discount superstore in the city’s west end.

At the cash register, TorontoToday asked about the federal policy and why the item wasn’t tax-exempt.

In response, the shop keeper handed over a quarter as reimbursement.

Village Media, the parent company of TorontoToday, will donate all of the kid’s toys purchased on Tuesday to charity.